2021 ev charger tax credit

Up to 3000 for apartment and condo buildings. Use this form to figure your credit for alternative fuel vehicle refueling property you placed in.

Rebates And Tax Credits For Electric Vehicle Charging Stations

The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit.

. New Brunswick offers a number of EV incentives for the purchase or lease of used or new electric vehicles and on home charging stations. New Brunswick EV incentives. Up to 5000 for the purchase of a new electric vehicle and up to 2500 for.

Up to 300 for a home EV charger. Up to 2000 per charger for workplace installation. The high growth was achieved despite the fact that the majority of the all-electric cars sold in the country were not eligible for the 7500 federal tax credit which in.

Customers who already own an eligible EV charger can earn 150 for joining the Program and then 50 at the end of the year and the next two years. Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year. Customers who are planning to purchase a new EV charger are eligible to enroll after installing and activating the charger and will receive 300 for signing up with a 3-year commitment.

Commercial Ev Charging Incentives In 2022 Revision Energy

Find Charging Options For Your Electric Vehicle Carolina Country

The Battle Within The Electric Vehicle Industry Will Intensify Electric Cars Bodywork Electricity

What S In The White House Plan To Expand Electric Car Charging Network Npr

Best Home Ev Charger 2022 Fuel Up Your Car At Home Zdnet

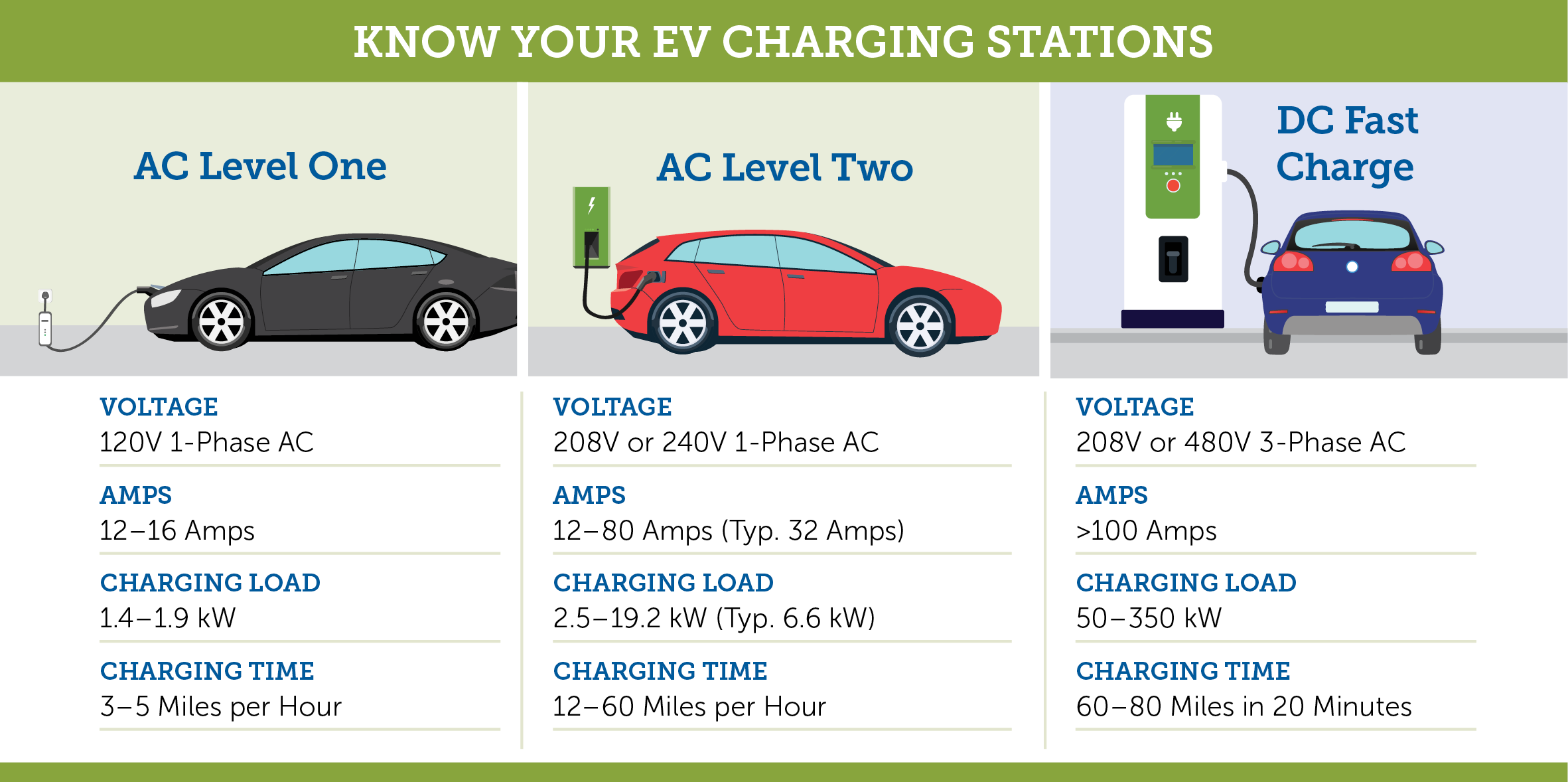

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

Tax Credit For Electric Vehicle Chargers Enel X

Rise In Number Of Electric Vehicle Registrations First Half Of 2021 Electric Cars Electric Vehicle Charging Hybrid Car